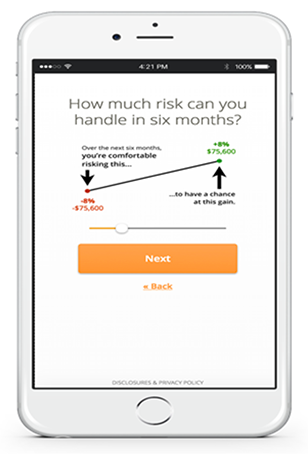

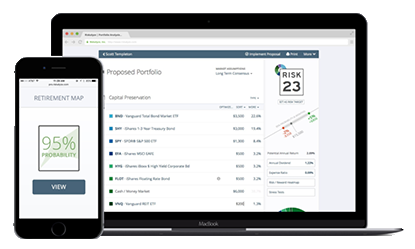

Our vision at First Citizens Bank is to inspire financial well-being for everyone. We use the term “financial well-being” to refer to your comprehensive financial health. Part of financial health includes having a strong investment strategy. In this blog post, we will discuss how we utilize a tool call Riskalyze to capture a client’s Risk Number® and engineer a portfolio to fit into an overall investment strategy.

July 26, 2021 by First Citizens Bank

By clicking the links above, you are now leaving First Citizens Bank's website and are going to a website that is not operated by the bank. First Citizens Bank is not responsible for the content; availability of linked sites; does not endorse or guarantee the products, information, or recommendations; and is not liable for any failure of products or services provided by the linked website. Please be advised that First Citizens Bank does not represent either the third party or you, the customer, if you enter into a transaction. Further, the privacy policy of this site owner may be different than that of the bank and this site may provide less security than the bank's website. We encourage you to read the privacy policies of websites reached through the use of links from the First Citizens Bank website.