A credit card may seem like just another tool to help you make purchases, but it can be much more. When used responsibly, a credit card can help you build a good credit history. This could allow you to get loans at favorable interest rates, insurance with lower premiums, or better pricing with a cellular plan.

The use of a credit card is directly connected to your credit score, the report card for borrowers. The responsible way you handle your credit card is recorded in your credit history for lenders to review. Your high score in that credit report shows how creditworthy you are, that you pay your bills on time, and you spend conservatively.

A credit card can also help you budget expenses each month, provided you pay your bill in full every time. If you do, your bill then acts as a master receipt that displays an itemized listing of what you spent your money on.

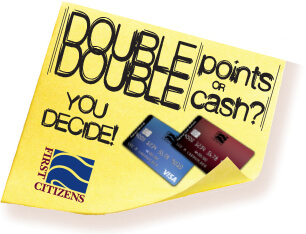

If you can manage your money responsibly, a credit card can be a very useful addition to your life. You could even earn perks! First Citizens offers a Visa® Platinum Rewards Credit Card, or a Visa® Platinum Cash Rewards Credit Card.

As a special offer, apply by February 29, 2020 for a First Citizens Visa credit card and get 2 points OR 2% cash back for every dollar you spend in the first 60 days! Apply today by clicking here or stop into the First Citizens location nearest you for an application.

As a special offer, apply by February 29, 2020 for a First Citizens Visa credit card and get 2 points OR 2% cash back for every dollar you spend in the first 60 days! Apply today by clicking here or stop into the First Citizens location nearest you for an application.

*Apply by February 29, 2020. New Platinum Rewards Credit Cards will earn two points for every $1 in net purchases during the first two billing cycles. New Platinum Cash Back Credit Cards will earn 2% cash back on net purchases made during the first two billing cycles. All points or cash rewards will post to your account during the statement cycle in which they are earned. Full Reward Program Terms and Conditions are provided with your new card. Cards subject to credit review and approval. Cards are issued by TCM Bank, N.A.

January 13, 2020 by First Citizens Bank

By clicking the links above, you are now leaving First Citizens Bank's website and are going to a website that is not operated by the bank. First Citizens Bank is not responsible for the content; availability of linked sites; does not endorse or guarantee the products, information, or recommendations; and is not liable for any failure of products or services provided by the linked website. Please be advised that First Citizens Bank does not represent either the third party or you, the customer, if you enter into a transaction. Further, the privacy policy of this site owner may be different than that of the bank and this site may provide less security than the bank's website. We encourage you to read the privacy policies of websites reached through the use of links from the First Citizens Bank website.