First Citizens Bank is committed to bringing the most up-to-date products and services to our customers. As we begin the New Year, this is a perfect time to take control of your finances and set some savings and budgeting goals for 2020. One way to do this comes FREE with First Citizens Online Banking, and is called Money Management.

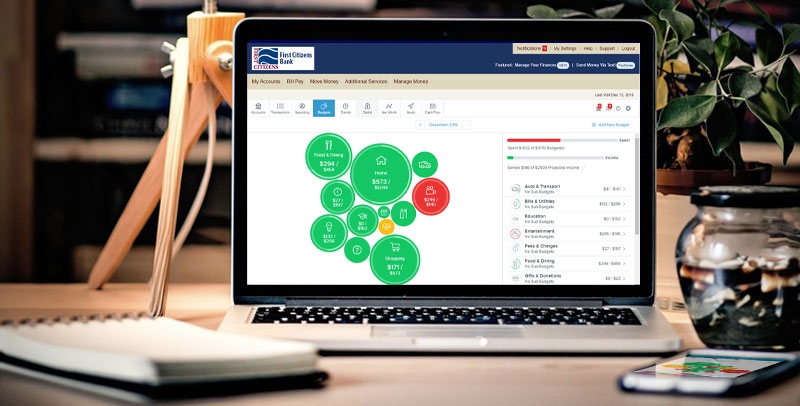

Money Management allows you to see a holistic picture of your finances all in one place. You can link any outside bank accounts, loans, credit cards, retirement funds, and much more. When you choose to include these accounts, you can then see your entire net worth at a glance. You can also set budgets, set savings goals, and view spending trends to keep you on track. Another great feature is the ability to show how much money you would save by paying off debts various ways (snowball method, fastest payoff first, highest rate first, etc). Money Management is also available on the mobile app!

Some of the other benefits of using Money Management include the ability to:

- See exactly where your money is going by categorizing expenses

- Set goals to get out of debit and stay out of debt

- Plan for retirement

- Ensure bills are paid on time

- Avoid being overdrawn

- Stay on top of your day-to-day finances

- Easily uncover any unusual account activity

We hope you find Money Management a useful tool in managing your finances in 2020. Whether your goal is to get out of debt, buy a home, or retire with dignity, the only way to reach those financial destinations is to make a plan and stick to it. To get started, log into your Online Banking account and click on "Money Management" found under "Manage Money" in the top navigation bar. To access Money Management via our mobile app, simply click on the "More" menu. If you have questions, hit the "? in a circle" icon or click the "Request Support" button within Money Management, visit our Money Management FAQ, or call us toll free during normal business hours at 800-423-1602.

January 6, 2020 by First Citizens Bank

By clicking the links above, you are now leaving First Citizens Bank's website and are going to a website that is not operated by the bank. First Citizens Bank is not responsible for the content; availability of linked sites; does not endorse or guarantee the products, information, or recommendations; and is not liable for any failure of products or services provided by the linked website. Please be advised that First Citizens Bank does not represent either the third party or you, the customer, if you enter into a transaction. Further, the privacy policy of this site owner may be different than that of the bank and this site may provide less security than the bank's website. We encourage you to read the privacy policies of websites reached through the use of links from the First Citizens Bank website.