Parents and grandparents often ask our team, “What are the best ways to save for college?” Despite escalating costs, and the debate as to whether a four-year degree is worth it, having a college education continues to open many doors to success. As college tuition and expenses continue to escalate, including college savings in your overall financial plan becomes increasingly important.

How much does college cost?

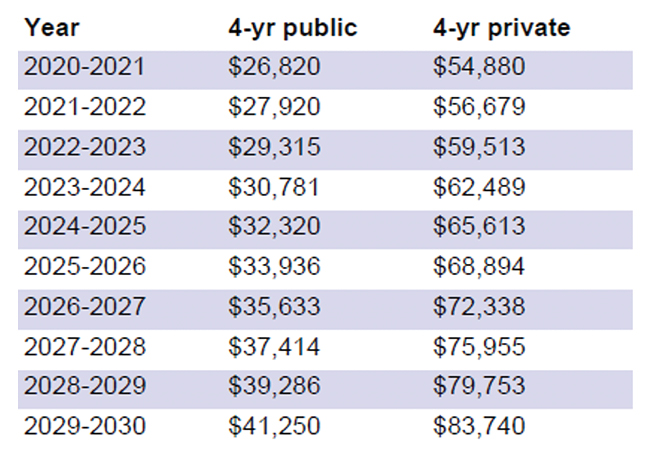

Before we can plan for college, we need to understand the potential cost. With the current average annual cost of college for in-state tuition pushing $30,000.00, a four-year degree can easily become one of the largest purchases a person makes during their lifetime.

*This chart shows the projected future costs based on average annual college inflation rate of 5%, College Board, Trends in College Pricing and Student Aid 2020.

How much should you save for college?

For many, saving enough to cover all the anticipated costs of college for a child, let alone multiple children, is unrealistic. We recommend those looking at saving for college for a loved one first ensure they are adequately saving for themselves. That is, put your oxygen mask on first ensuring a solid retirement plan is in place. If you have done so, you have identified the amount you can realistically contribute to college savings. This is where you start.

What vehicles can I use to save for college?

There are a variety of investment vehicles and planning tools that can be utilized to save for college.

1. A 529 College Plan

A 529 plan, formally known as Qualified Tuition Program, is a special tax-advantaged savings account you can use to cover college expenses. The money kept in this account is free from federal income tax, and funds remain tax-free when you withdraw them for qualified college expenses. These plans vary by state. While you can take advantage of another state’s plan, in-state owners usually enjoy more benefits.

Pros:

- Tax benefits

- Easy to manage

- Automatic investment options

- Unlimited contribution

Cons:

- Money must be used for higher education (although some plans for elementary and high school education exist as well)

- May affect financial aid eligibility

- Limited investment options

2. Roth IRA

A Roth IRA is a special individual retirement account that allows you to make qualified tax-free withdrawals. Paying for higher education qualifies. This IRA account is similar to a traditional IRA, but Roth IRAs are funded by after-tax dollars and the contributions aren’t tax-deductible. You can withdraw up to the amount you contributed at any time without penalties.

Pros:

- Flexibility (can be used for other purposes besides higher education)

- Doesn’t affect financial aid eligibility

- Numerous investment options

Cons:

- Contribution limits and income restrictions

- If you withdraw money for any purpose, it counts as income on future Free Application for Federal Student Aid (FAFSA) applications.

- No state income tax deduction

3. Savings Bonds

Savings bonds are issued by the United States Department of Treasury to keep your money for a set period in exchange for a certain interest rate. Simply said, you are loaning the money to the government to get a little more back in the future when your child goes to college. U.S. savings bonds (Series EE and I) offer advantages to parents who want to save money for college, are virtually risk-free, and come with tax benefits for higher education when all requirements are met.

Pros:

- Low-risk, guaranteed by the U.S. government

- Tax advantages

- Small impact on financial aid

Cons:

- Small interest

- Not every owner is eligible for tax advantages

4. Custodial Accounts

A custodial savings account is a savings account that you set up for the child but have full control of until they reach legal age. You contribute to the account as you would to Roth IRA or 529 plan. An account manager invests the money for you.

Pros:

- Easy to manage

- Easy to withdraw money at any time

- No penalties for withdrawals if used for a child’s needs

- No contribution limits

Cons:

- No tax benefits

- Reduces eligibility for financial aid.

5. Education Savings Accounts (ESA)

An Education Savings Account (also known as Coverdell accounts) is very similar to the 529 plan. With an ESA, you have an opportunity to choose any kind of investment (stocks, mutual funds, bonds), which makes this option a more flexible choice.

Pros:

- Federal tax benefits

- Flexibility (can be used for elementary and high school education)

- FDIC insurance coverage

Cons:

- Income limitations

- Contribution limitations

- Non-qualified withdrawals are taxed

College financial planning can be confusing, and it’s possible to make mistakes even with sufficient research. Working with a trusted wealth management professional can help you gain valuable assistance in estimating expenses and selecting the right savings approach. If you have any questions about financial planning for college, contact wealth@myfcb.bank today. We are always here to help.

April 26, 2021 by First Citizens Bank

By clicking the links above, you are now leaving First Citizens Bank's website and are going to a website that is not operated by the bank. First Citizens Bank is not responsible for the content; availability of linked sites; does not endorse or guarantee the products, information, or recommendations; and is not liable for any failure of products or services provided by the linked website. Please be advised that First Citizens Bank does not represent either the third party or you, the customer, if you enter into a transaction. Further, the privacy policy of this site owner may be different than that of the bank and this site may provide less security than the bank's website. We encourage you to read the privacy policies of websites reached through the use of links from the First Citizens Bank website.