Our Blog Posts

Our Blog Posts

Creating a Vision for Your Retirement

September 20, 2021

What comes to mind when you daydream about retirement? Is it travel? Time with family? Less responsibility? While it may be easy to conjure up these images, too often the planning stops with the daydream and we fail to really think through what our vision is and how we plan to get there. Getting started as early as possible in your retirement planning is important, but for those nearing the 5-10 year countdown to retirement it starts to become more real. It is now time to shift from deciding how much I need to save each year to beginning some soul-searching about what you want retirement to look like. Here a few questions you might start working through: What is your vision for retirement? Will you completely stop working or engage in some form of part-time work? Will you relocate? Will you travel more? Spend more time with family and friends? Volunteer

When Should I Start Taking Social Security?

December 20, 2021

Considering taking Social Security in 2022? Consider this first. In October, the Social Security Administration (SSA) confirmed the cost-of-living adjustment (COLA) will increase by 5.9% in January. With a 5.9% increase to their Social Security benefit, many are wondering if they should start collecting Social Security now. Usually, the earliest you can take Social Security is age 62. But just because you can doesn’t mean you should. We get asked about the

End of Year Charitable Giving

November 29, 2021

November is National Gratitude month and what better way to show gratitude than through charitable giving. Research shows that people who practice gratitude every day are not only happier but also healthier. So, if you were looking for reasons to be thankful, then these benefits should be just the motivation you need. In 2020, despite the pandemic and economic volatility, charitable giving reached a record $471.44 billion. Besides

Attending to Year End Tax Planning

October 25, 2021

At the end of the year, it’s important to think about taxes and year-end tax planning. We’re going to discuss a few things to consider as you weigh potential tax moves before the end of the year. if you might be in a lower tax bracket next year, defer income until then. For example, you may be able to defer a year-end bonus or delay the collection of business debts, rents, and payments to postpone payment of tax on the income until next year. Look for opportunities to

Creating a Vision for Your Retirement

September 20, 2021

What comes to mind when you daydream about retirement? Is it travel? Time with family? Less responsibility? While it may be easy to conjure up these images, too often the planning stops with the daydream and we fail to really think through what our vision is and how we plan to get there. Getting started as early as possible in your retirement planning is important, but for those nearing the 5-10 year countdown to retirement it starts to become all

Empowering Women and Wealth

August 23, 2021

We all lead busy lives, but women tend to place our family and work needs before our own. We are excellent at managing our daily lives, but many times fail to take the time to consider our future financial needs. Statistics show men are more likely to seek out financial advice than women. Combine that with the fact that women often outlive men, and we have a recipe for disaster. As illustrated above: Women control 51% of the personal wealth in the U.S. Women

Crafting Your Investment Strategy

July 26, 2021

Our vision at First Citizens Bank is to inspire financial well-being for everyone. We use the term “financial well-being” to refer to your comprehensive financial health. Part of financial health includes having a strong investment strategy. In this blog post, we will discuss how we utilize a tool call Riskalyze to capture a client’s Risk Number® and engineer a portfolio to fit into an overall investment

Special Needs Require Special Planning

June 28, 2021

Our vision at First Citizens Bank is to inspire financial well-being for everyone. We use the term “financial well-being” to refer to your comprehensive financial health. Preparing for the future when you won't be here to care for your family is a challenge that all parents face. But as the parent of a child with special needs, your estate planning is especially complex. Our Trust Officers have experience working with families to provide peace of mind in navigating

Create a Budget With Purpose

May 24, 2021

For many Americans, the idea of an unanticipated expense, like a car breaking down, is cringeworthy. If you had to come up with $5000 today to pay for a car repair, how would you feel? Are your palms sweating? What if instead of your car needing a repair, you experience an unexpected job loss? Now, do we have your attention? Although “Budgeting” is our topic this month we didn’t want to scare you with bringing up this dreaded word before grabbing your attention. Too often,

Saving for College

April 26, 2021

Parents and grandparents often ask our team, “What are the best ways to save for college?” Despite escalating costs, and the debate as to whether a four-year degree is worth it, having a college education continues to open many doors to success. As college tuition and expenses continue to escalate, including college savings in your overall financial plan becomes increasingly important. How much does college cost? Before we can plan for college, we need to understand the potential

Basic Financial Planning

March 29, 2021

How comfortable are you with your future finances? Do you have a financial plan? It's not just about retirement. It's about budgeting, planning, and investing for your future. When it comes to the financial planning process, we utilize a tool called eMoney to assist clients in developing a financial plan. A plan includes the collaboration of members of the wealth advisory, fiduciary, and investment teams of First Citizens Wealth Management as well as coordination with outside professionals.

View More Blog Posts

Caring for an Aging Parent? You Are Not Alone.

February 22, 2021

For many people, one of the most difficult conversations to have involves talking with an aging parent about declining health. The shifting of roles often creates strong emotions. Family dynamics can also lead to tension when siblings don’t all agree on the best course of action. All too often, critical conversations don’t occur until problems have arisen, and sometimes they never happen at all. Over the years, we’ve helped many families navigate these conversations.

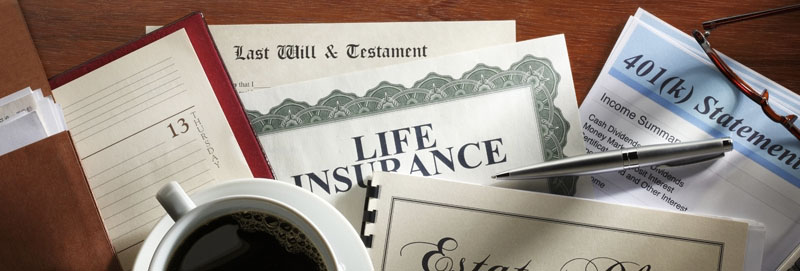

Estate Planning in 2021

January 25, 2021

Last year, we kicked off January by providing education centered around the important topic of estate planning. As we begin 2021 and transition to a new administration in Washington, it is yet again a good time to remind our valued clients of the importance of estate planning. A couple things to consider in 2021: Get organized. Often, families are left gathering statements and searching out information in the wake of an unexpected loss. A new year is a great time to gather your information

A Relationship That Goes Beyond Banking

October 26, 2020

We may have told you a time or two, but here at First Citizens Wealth Management, we’re A Team You Can TRUST. And in this article, we’re going to explore yet another reason why. Did you know we offer retirement planning services on more than just an individual level? We’ve entered a partnership with EPIC Retirement Plan Services (EPIC RPS) to provide you and your business with retirement plan services. First let’s discuss why it’s important to offer a retirement

Have You Thought About Retirement Planning?

September 28, 2020

As we transition from warm summer weather into crisp fall days, it’s a good time to think about the future. Retirement planning is such an important part of your future, and it starts with thinking about your retirement goals. And not just your goals, but how long you have to meet them, how important each one is, and the likelihood that you can make it all happen. There are so many things to think about. What expenses will you have in retirement? What other income will you have? What about

Curious About Weekly Market Summaries?

July 29, 2019

Weekly Market Summaries is a feature in the Resources section under Wealth Management on our website. The summaries contain information on the Dow, S&P 500, NASDAQ, Russell 2000, Global Dow, Federal Funds interest rate, and 10-year Treasury yields as well as highlights of past and future economic data. Want to know what the market summaries are for this week? If so, click here. Products provided by First Citizens Wealth Management are not insured by the FDIC, are not deposits of

What to Bring to an Estate Planning Consultation with our Team

July 1, 2019

Do you have all your ducks in a row with your estate plan? If you answer yes, let me ask you when the last time you reviewed it was? Are you clear on what happens when you die? Yes, I said it…when you die. There are few guarantees in life but one that I can guarantee you is that you will, in fact, die. Having practiced probate law myself, I have seen the negative impact of failing to accept that fact until it is too late. The widow sorting through stacks of documents trying to locate everything

Time for a Mid-Year Investment Check

May 27, 2019

Many investors may be inclined to review their portfolios only when markets hit a rough patch, but careful planning is essential in all economic climates. So whether the markets are up or down, periodically reviewing your portfolio with your financial professional can be an excellent way to keep your investments on track, and midway through the year is a good time for a checkup. Here are three questions to consider. 1. How have my investments performed so far this year? Review a summary of your

Let's Talk About Risk

April 29, 2019

In the last Wealth Management blog post entitled "What Am I Really Paying for My Investments", we discussed various types of fees and expenses associated with investments. At the end of the day, building a solid investment strategy requires understanding not only the cost to do so but also your unique risk and reward preferences. Our team has been incorporating a cutting edge tool to assist demystifying the conversation around risk. How does it work? Simply click here and you will run through

What Am I Really Paying For My Investments?

March 25, 2019

This is a question that all clients of financial advisors should know the answer to, but unfortunately, we suspect few people really have a good handle on. At First Citizens Wealth Management, we feel that one of the most important things we can do is be very transparent about the fees and expenses associated with being a client of our organization. Here is a brief overview of the different types of costs a client may pay when working with a financial advisor: Commissions: This was once the

Famous People Who Failed to Plan Properly

January 28, 2019

It's almost impossible to overstate the importance of taking the time to plan your estate. Nevertheless, it's surprising how many American adults haven't done so. You might think that those who are rich and famous would be way ahead of the curve when it comes to planning their estates properly, considering the resources and lawyers presumably available to them. Yet there are plenty of celebrities and people of note who died with inadequate (or nonexistent) estate plans. Most recently The

Helpful Articles

Helpful Articles

Education Center

Products provided by First Citizens Wealth Management are not insured by the FDIC, are not deposits of the bank and are not guaranteed by this institution; and, are subject to investment risks, including possible loss of the principal invested. Please note that neither First Citizens Bank nor the First Citizens Wealth Management Department provide tax or legal advice.